Market Information

Pan Asia Pacific

Pan Asia Pacific

-

Australia Live Price Feed Subscription

Contact your Trading Representative to subscribe to Live Price Feed for the Australia market at S$22 per month.

-

Commission rate and charges

-

Minimum bid size

Share price Minimum bid size Below A$0.10 A$0.001 A$0.10 to $1.995 A$0.005 Above A$2.00 A$0.01 -

Trading holidays

-

Trading abbreviations

The following trading abbreviations will appear in the “Remarks” column on iOCBC trading platform. To find out more information on the corporate action or trading status on the listed companies, kindly refer to the official websites of the respective Exchanges.

Abbreviation Corporate Action Description CD Cum Dividend CR Cum Right Issue CT Conditional Trading XB Ex-Bonus XE Ex Entitilement XF Ex Take Over XC Ex Capital Return PU Protection Unavailable XM Ex Premium Return XQ Ex Equal Access Buy Back XI Ex Interest CL Call Due CZ Cum Priority RE Reconstructed XD Ex-Dividend XR Ex Rights Issue CB Cum Bonus Issue CE Cum Entitlement CF Cum Takeover Offer CC Cum Capital Return PA Protection Available CM Cum Premium Return CQ Cum Equal Access Buy-Back NX New Ex Interest CI CI -Cum Interest CP CP - Call Paid XZ XZ - Ex Priority RA RA - Receiver Appointed Abbreviations Trading Status OPN Open SUS Suspended NQ Enquire TH Trading Halt AUT Adjust Mode NDR Pre Open Notice Received HRS Regulatory Trading Halt AUC CSPA CLS Close POP Pre Open FAS Late Trading POQ Pre CSPA OVR Open Night Trading SC Purge orders/System Maintenance AIS International Halt -

Declaration

Declaration form for Australian residency status for tax purposes

All assessment income earned in Australia is subject to taxation. This includes income from corporate actions such as dividends. The amount of tax to be withheld depends on whether the recipient is a resident/non-resident of Australia or in the case of non-resident, if the country has a treaty with Australia. In this aspect, customer is required to make a one-time declaration on their Australian Residency Status and hence the tax rates applicable to him.

Customers who wish to trade in Australia Exchange are required to sign and submit the original declaration form to OCBC Securities before commencement of trading.

For more details on the rules and guidelines on Australian Residency for Tax Purposes, you may visit the Australian Taxation Office website at http://www.ato.gov.au.

-

Order Price Restriction

Stock Price Restriction* Example of Reject Message All Order price cannot be more than 25% away from Last Close “Price failed profile checks” All Order quantity cannot be more than 20-day Average Daily Volume “Order quantity is xxx% of Average Daily Volume exceeding...” < 0.15 AUD For BUY order, price cannot be more than Reference Price.

For SELL order, price cannot be less than Reference Price.

“Order price deviation xxx ticks exceeds the maximum limit of 0 ticks from the last traded price” ≥ 0.15 AUD For BUY order, price cannot be more than 5% higher than Reference Price.

For SELL order, price cannot be more than 5% lower than Reference Price.

“Order price deviation xxx% exceeds the maximum limit of 5% from the last traded price”

*Reference Price is based on the following (in the following order):1. Indicative Auction Price (IAP) during Pre-opening

2. Best Bid/Ask ('Bid' for BUY, 'Ask' for SELL)

3. Last traded price

4. Last closing price -

Pre-closing sessions

Pre-closing session is available only for broker-assisted trades.

-

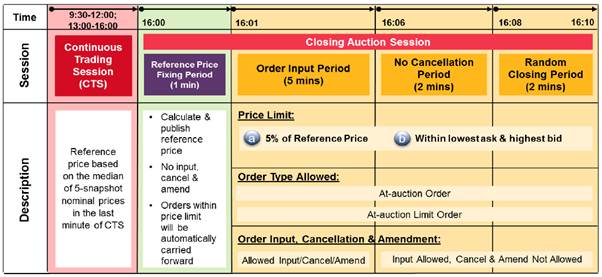

Closing Auction Session (CAS)

What is Closing Auction Session?

The Closing Auction Session is a market structure change implemented by the HKEX. During the session, market participants interested in trading at the closing price may input buy and sell orders. These orders will interact with each other to form a consensus closing price for each security and orders are executed at that price. The CAS commences immediately after the Continuous Trading Session and will last for about 8 to 10 minutes.Effective 8 October 2019, the list of securities covered by CAS expands to include all equities (including depositary receipts, investment companies, preference shares and stapled securities), as well as funds (including exchange traded funds (ETFs) and real estate investment trusts).

For the list of CAS securities, please refer to the "CAS Eligible" indicator under the Full List of Securities available on HKEX website.

For more information, please refer to HKEX’s CAS Microsite and FAQ.

How to submit orders for Closing Auction Session in iOCBC?

Open orders from Continuous Trading Session will automatically carry over into CAS if order price is within price limit. Clients can also submit the following order types to participate during CAS.- At-auction;

- At-auction Limit; and

- Limit (will be automatically converted to At-auction Limit order by iOCBC).

- Enhanced Limit (will be automatically converted to At-auction Limit order by iOCBC).

During the Reference Price Fixing Period, the exchange does not accept new orders. Hence, orders submitted to iOCBC during this period will be stored and released during the Order Input Period.

-

Hong Kong Live Price Feed Subscription

Contact your Trading Representative to subscribe to Live Price Feed for the Hong Kong market at S$45 per month.

-

Volatility Control Mechanism (VCM)

What is Volatility Control Mechanism?

The VCM is based on the regulatory guidance of the Group of Twenty (G20) and International Organization of Securities Commissions (IOSCO), and is designed to prevent extreme price volatility from trading incidents such as a “flash crash” and algorithm errors, and to address systemic risks from the inter-connectedness of securities and derivatives markets. Many international exchanges have implemented some form of volatility control mechanisms to control extreme price volatility.

HKEX’s VCM

HKEX VCM will trigger a cooling-off period for 5 minutes if the price deviates more than a predefined percentage within a specific time frame. The VCM for the securities market will be implemented on 22 August 2016. For more information, please refer to HKEX’s VCM microsite and FAQ.

Instruments covered under the VCM

In the securities market, VCM will only be applied to Hang Seng Index (HSI) and Hang Seng China Enterprises Index (HSCEI) constituent stocks (together the VCM securities). You can also refer to the finalised list of the VCM securities.

For more information, please refer to HKEX’s Trading Mechanism of Volatility Control Mechanism (VCM).

-

Commission rate and charges

-

Minimum bid size

Stocks:

Share Price (HKD)

Minimum Bid Size (HKD)

$0.01 to $0.25

$0.001

> $0.25 to $0.50

$0.005

> $0.50 to $10.00

$0.010

> $10.00 to $20.00

$0.020

> $20.00 to $100.00

$0.050

> $100.00 to $200.00

$0.100

> $200.00 to $500.00

$0.200

> $500.00 to $1,000.00

$0.500

> $1,000.00 to $2,000.00

$1.000

> $2,000.00 to $5,000.00

$2.000

> $5,000.00 to $9,995.00

$5.000

Exchange Traded Funds (ETFs):

Share Price (HKD)

Minimum Bid Size (HKD)

$0.01 to $0.25

$0.001

> $0.25 to $0.50

> $0.50 to $1.00

> $1.00 to $5.00

$0.002

> $5.00 to $10.00

$0.005

> $10.00 to $20.00

$0.010

> $20.00 to $100.00

$0.020

> $100.00 to $200.00

$0.050

> $200.00 to $500.00

$0.100

> $500.00 to $1,000.00

$0.200

> $1,000.00 to $2,000.00

$0.500

> $2,000.00 to $5,000.00

$1.000

> $5,000.00 to $9,999.00

-

Hong Kong Order Types and User Guide

Customers are able to select their order types available in Hong Kong Exchange.

1) Limit Order (LO)

2) Enhanced Limit Order (ELO)

3) Special Limit Order (SLO)

4) At-Auction Order (AO)

5) At-Auction Limit Order (ALO)

More information on the Order Type and User Guide. -

Trading holidays

-

Trading sessions

-

Trading abbreviations

The following trading abbreviations will appear in the “Remarks” column on iOCBC trading platform. To find out more information on the corporate action or trading status on the listed companies, kindly refer to the official websites of the respective Exchanges.

Abbreviation Trading Status SUS Halt RCK Threshold break in last trade price; Pre-market Open Nominal

(i.e. RCK will be shown when there is no transaction done during the Pre-Opening session)

-

Commission rate and charges

-

Minimum bid size

Share price (IDR) Tick size (IDR) Max Price Movement (IDR) < 200 1 10 200 to < 500 2 20 500 to < 2000 5 50 2000 to < 5000 10 100 ≥ 5000 25 250 Auto Rejection Rules

No

Reference Price

Auto Rejection Limit

1

Rp50,00 s.d. Rp200,00

7%

2

>Rp200,00 s.d. Rp5.000,00

7%

3

>Rp5.000,00

7%

Order price must be within the following range from Reference Price to avoid being rejected by Exchange. Reference Price refers to, in order of priority, Opening Price, First Trade Done Price and Previous Day Last Done Price.

-

Trading holidays

-

Trading abbreviations

The following trading abbreviations will appear in the “Remarks” column on iOCBC trading platform. To find out more information on the corporate action or trading status on the listed companies, kindly refer to the official websites of the respective Exchanges.

Abbreviation Corporate Action Description CD Cum Dividend CB Cum Bonus CR Cum Right CA Any Combination of Cum Remarks

(e.g. cash dividend, stock dividend and / or stock bonus)

XD Ex Dividend XB Ex Bonus XR Ex Right XA Any combination of Ex Remarks RS Reverse Stock SS Stock Split Abbreviation Trading Status RCK Threshold Break SUS Suspended CLL Trading at Last -

Securities in Special Monitoring

Full Call Auction

With effect from 25 March 2024, IDX will be implementing a Full Call Auction for securities in Special Monitoring as part of an ongoing initiative to increase investor protection. Securities that are listed under Special Monitoring Board are determined by Exchange based on certain criteria.

Securities that are under Special Monitoring shall follow the Full Call Auction Process.

Please refer to this webpage (List of Securities Under Special Monitoring (idx.co.id)) for the list of securities that IDX identifies to be in the Special Monitoring Board.

Full Call Auction Process

There are 5 sessions of Full Call Auctions during a Monday-Thursday trading day and 4 sessions of Full Call Auctions during a Friday. Orders submitted will only be matched at the end of the call auction.

The lower limit of auto-rejection for Special Monitoring Board is IDR 1 for securities priced between IDR 1 and IDR 10, and 10% away from last done price for securities priced more than IDR 10. There is no rejection for maximum price movement.

Auto Rejection Rules:

Reference Price Auto Rejection Lower Limit Auto Rejection Upper Limit IDR 1 to IDR 10 IDR 1 - >IDR 10 10% away from last done price -

Trading Hours (SGT)Monday – Thursday

Special Monitoring Board Session Call Auction Random Closing Order Matching Phase Session 1 10.00am – 10.55am 10.53am – 10.55am 10.55.01am – 10.59.59am Session 2 11.00am – 11.55am 11.53am – 11.55am 11.55.01am – 11.59.59am Session 3 12pm – 12.55pm 12.53pm – 12.55pm 12.55.01pm – 12.59.59pm Break 1pm – 2.59.59pm Session 4 3pm – 3.55pm 3.53pm – 3.55pm 3.55.01pm – 3.59.59pm Session 5 4pm – 4.55pm 4.53pm – 4.55pm 4.55.01pm – 4.59.59pm Post-Trading Session 5.01pm – 5.15pm

FridaySpecial Monitoring Board Session Call Auction Random Closing Order Matching Phase Session 1 10.00am – 10.55am 10.53am – 10.55am 10.55.01am – 10.59.59am Session 2 11.00am – 12.25pm 12.23pm – 12.25pm 12.25.01pm – 12.29.59pm Break 1pm – 2.59.59pm Session 3 3pm – 3.55pm 3.53pm – 3.55pm 3.55.01pm – 3.59.59pm Session 4 4pm – 4.55pm 4.53pm – 4.55pm 4.55.01pm – 4.59.59pm Post-Trading Session 5.01pm – 5.15pm No actions required for users/clients.

-

Commission rate and charges

-

Minimum bid size

TOPIX500 Constituents (TOPIX100 and TOPIX Mid400 Constituents)

Price per share (yen)

Tick Size (yen)

up to

1,000

0.1

up to

3,000

0.5

up to

10,000

1

up to

30,000

5

up to

100,000

10

up to

300,000

50

up to

1,000,000

100

up to

3,000,000

500

up to

10 million

1,000

up to

30 million

5,000

over

30 million

10,000

Other Issues

Price per share (yen)

Tick Size (yen)

up to

3,000

1

up to

5,000

5

up to

30,000

10

up to

50,000

50

up to

300,000

100

up to

500,000

500

up to

3 million

1,000

up to

5 million

5,000

up to

30 million

10,000

up to

50 million

50,000

over

50 million

100,000

-

Trading holidays

-

Trading abbreviations

The following trading abbreviations will appear in the “Remarks” column on iOCBC trading platform. To find out more information on the corporate action or trading status on the listed companies, kindly refer to the official websites of the respective Exchanges.

Abbreviation Corporate Action Description XN Ex New XD Ex Dividend OXR Other Ex Right XND New Stock, Ex Dividend XNR New Stock, Other Ex Right DXR Dividend, Other Ex Right NDX New Stock, Dividend, Other Ex Right XRD Ex RIght, Deposit Certificate Abbreviation Trading Status * ZARABA Close C Close H Normal trading status and the Last Price if of equal value as High Price L Normal trading status and the Last Price if of equal value as Low Price # Period suspension

-

Commission rate and charges

-

Minimum bid size

KRX KOSPI Share Price Minimum bid size Less than KRW1,000 KRW1 KRW1,000 to less than KRW5,000 KRW5 KRW5,000 to less than KRW10,000 KRW10 KRW10,000 to less than KRW50,000 KRW50 KRW50,000 to less than KRW100,000 KRW100 KRW100,000 to less than KRW500,000 KRW500 Greater than or equal to KRW500,000 KRW1,000 KRW KOSDAQ Share Price Minimum bid size Less than KRW1,000 KRW1 KRW1,000 to less than KRW5,000 KRW5 KRW5,000 to less than KRW10,000 KRW10 KRW10,000 to less than KRW50,000 KRW50 Greater than or equal to KRW50,000 KRW100 -

Trading holidays

-

Trading abbreviations

These will appear in the “remarks” column on the trading platform.

Abbreviation Description RCK RCK will be shown when there is no transaction done during the Pre-Opening session

-

Bursa Malaysia Live Price Feed Subscription

Contact your Trading Representative to subscribe to Live Price Feed for the Malaysia market at S$2 per month.

-

Commission rate and charges

-

Minimum bid size

Tick sizes for securities traded and quoted on Bursa

Share price (MYR) Minimum bid size (MYR) Below RM1.00 0.005 RM1.00 to RM9.99 0.01 RM10.00 to RM99.98 0.02 RM100.00 and above 0.10 - There is no force key for Bursa Market

- Order will be rejected if the price entered is more than 30% of the last traded price

- For odd lot quantity, kindly place your order through a broker

Tick sizes for ETF

Securities Market price (MYR) Minimum bid size (MYR) ABFMY1 At any price 0.001

Equity-based ETFs

Below RM1.00 0.001 Between RM1.00 to RM2.995 0.005 RM3.00 and above 0.01 - For bonds, debentures, loan securities, warrants and call warrants, the minimum bid structure will have the same minimum trading spreads as for shares

-

Trading holidays

-

Trading abbreviations

The following trading abbreviations will appear in the “Remarks” column on iOCBC trading platform. To find out more information on the corporate action or trading status on the listed companies, kindly refer to the official websites of the respective Exchanges.

Abbreviation Trading Status TH Trading Halt TRE Ready to Trade CLL Trading at Last -

Additional remarks

REINSTATEMENT OF THE RULINGS ON CIRCUIT BREAKER (CB) GUIDELINES – STATIC AND DYNAMIC PRICE LIMITS FOR FBMKLCI COMPONENT STOCKS AND BURSA MALAYSIA CB TRIGGER LEVELS

1. Static and Dynamic Price Limits for FBMKLCI Component Stocks (from 31 May 2021)Securities Prices

Security Type

Static Price Limita

Dynamic Price limitb

FBMKLCI Index component stocks

More than or equivalent to RM1.00

Upper limit price +30%

Lower limit price -30%Upper dynamic limit +8%

Lower dynamic limit -8%Less than RM1.00

Upper limit price +30 sen

Lower limit price -30 senUpper dynamic limit +8 sen

Lower dynamic limit -8 sen

Note

a) Static Price Limit: Lower limit price reverts back to -30% from -15% for securities prices >=RM1.00, and to -30 sen from -15 sen for securities prices < RM1.00;

b) Dynamic Price Limit: Lower dynamic limit reverts back to -8% from -5% for securities prices >=RM1.00, and to -8 sen from -5 sen for securities prices < RM1.00

2. Bursa Malaysia Circuit Breaker Trigger Levels (from 31 May 2021)

Note: Temporary revision of the circuit breaker levels to two trigger levels (10% and 15% only) will revert to three trigger levels (10%, 15% and 20%)Bursa Malaysia Circuit Breaker Trigger Levels/ Conditions and Trading Halt Duration Trigger Level

FBMKLCI Decline

From 9:00 am– before 11:15 am

From 11:15 am to 12:30 pm

From 2:30 pm – before 3:30 pm

From 3:30 pm to 5:00 pm

1

FBMKLCI falls by an aggregate of 10% or more but less than 15% of the previous market day's closing index.

1 Hour

Rest of Trading Session

1 Hour

Rest of Trading Session

2

FBMKLCI falls by an aggregate of or to more than 15% but less than 20% of the previous market day's closing index.

1 Hour

Rest of Trading Session

1 Hour

Rest of Trading Session

3

FBMKLCI falls by an aggregate of or to more than 20% of the previous market day's closing index.

9.00 a.m. - 12.30 p.m

2.30 p.m. - 5.00 p.m

Rest of Trading Day

Rest of Trading Day

Visit Securities Commission Malaysia for more detailed information.

DECLARATION FORM FOR CUSTOMERS TRADING IN THE MALAYSIAN MARKET

Customers who wish to trade in Malaysian shares (Bursa Malaysia) are required to make a one-time declaration on their Malaysian residency status to OCBC Securities.

In compliance with Bank Negara Malaysia Foreign Exchange Administration (FEA) Rule, any sales proceeds and contra gains in relation to Malaysia stock holdings held by Malaysia residents are strictly required to be made in Ringgit.

If you wish to receive monies in foreign currency, you will need to sign and submit a one-time Declaration Form to allow us to act on your future instructions on the conversion of MYR to a foreign currency.

REVISION OF STRUCTURED WARRANTS REFERENCE PRICE AND STATIC PRICE LIMITS

Please be informed that effective 19 June 2017, the calculation of Reference Price and Static Price Limits of Structured Warrants in Bursa Malaysia will be revised.

The revision is applicable to Normal Market, Odd Lot Marker and Buying-In Market segments.

Currently the Reference Price refers to the closing price/previous close price.

The following are the key points of the revision:

1) When there is any trade executed in the 1st Trading Session

- The Last Done Price at the Completion of the 1st Trading Session will be the Reference Price for the 2nd Trading Session.

- Static Price Limits for the 2nd Trading Session will be based on the Reference Price.

2) If there is NO TRADE EXECUTED in the 1st Trading Session

- If there is a BUY (or SELL) order at the Upper Limit or (as the case may be) Lower Limit Price, then the Reference Price for the 2nd Trading Session is the Upper Limit Price or (as the case may be) the Lower Limit Price at the end of the 1st Trading Session; or

- Reference Price of the 1st Trading Session.

- Static Price Limits for the 2nd Trading Session will be based on the Reference Price.

3) At 12:35pm, all active orders residing in the Normal and Odd Lot Market segments will be revalidated against the new Static Price Limits. Orders which are outside the 30% (or 30 percent) band of the Static Price Limits will be purged by the Exchange trading system.

4) If there is one or more trades executed in a Trading Day or Half Trading Day, the Closing Price will be the Reference Price at the start of the next Trading Day.

5) Kindly note that this change is not applicable on the first day of listing/quotation.

For detailed information, please refer to the following link: https://www.bursamalaysia.com/sites/5bb54be15f36ca0af339077a/assets/5bb55a8d5f36ca0c3028d86f/Amendments_To_Participating_Organisations__Trading_Manual___Trading_Manual___In_Relation_To_The_Revision_Of_Structured_Warrants_Reference_Price_And_Static_Price_Limits.pdf

-

Commission rate and charges

-

Minimum bid size

Share Price Minimum bid size (NZD) Up to NZ$0.20 NZ$0.001 From NZ$0.20 to NZ$0.50 NZ$0.005 Above NZ$0.50 NZ$0.01 -

Trading holidays

-

Commission rate and charges

-

Trading Restrictions

Please note that Philippine peso is a controlled currency and a Bangko Sentral Registration Document (BSRD) certificate must be registered before sales proceeds can be received in a foreign currency after conversion from Philippine peso.

As a BSRD certificate is issued only after the Buy contract is settled, buy and sell trades are subject to the following restrictions.

Trade Type Requirement Buy No contra allowed.

All purchase contracts will need to be settled by T+3.

Sell Sales proceeds pertaining to its corresponding earlier buy and subsequent sell trade will only be received by Tbuy + 6 or Tsell + 3, whichever is later.

Philippines ETF not available on iOCBC

We have instituted the following trading restriction on the following counter listed below as it is not registered with the Bangko Sentral ng Pilipinas. This means that foreign investors investing in this counter are not entitled to full repatriation of capital and remittance of dividends/profits using foreign exchange sourced/purchased from authorised agent banks and/or their subsidiary/affiliate foreign exchange corporations.

S/No Stock Name Stock Code Market Note 1 FIRST METRO PHIL. EQUITY EXCHANGE TRADED FUND FMETF Philippines Stock Exchange Only Sell orders permitted;

Buy orders not permitted -

Minimum bid size

Stocks quoted on all the mining and oil stocks in Philippines Stock Exchange are quoted in ‘number of shares’ instead of Board Lot. For example, Dizon Copper, Vulcan Inds etc.

Share price (PHP) Minimum bid size (PHP) Share per board lot 0.0001 up to 0.0099 0.0001 1,000,000 0.0100 up to 0.0490 0.0010 100,000 0.0500 up to 0.2490 0.0010 10,000 0.2500 up to 0.4950 0.0050 10,000 0.5000 up to 4.9900 0.0100 1,000 5.0000 up to 9.9900 0.0100 100 10.0000 up to 19.9800 0.0200 100 20.0000 up to 49.9500 0.0500 100 50.0000 up to 99.9500 0.0500 10 100.0000 up to 199.9000 0.1000 10 200.0000 up to 499.8000 0.2000 10 500.0000 up to 999.5000 0.5000 10 1000.0000 up to 1999.0000 1.0000 5 2000.0000 up to 4998.0000 2.0000 5 5000.0000 and up 5.0000 5 -

Trading holidays

-

Stock abbreviations

The following trading abbreviations will appear in the “Remarks” column on iOCBC trading platform. To find out more information on the corporate action or trading status on the listed companies, kindly refer to the official websites of the respective Exchanges.

Abbreviation Corporate Action Description XD Dividend Payment in Cash XI Interest Payment XSS Split XB Bonus BGB Reverse Split XC Capital Reduction XR Rights OTH Bonus and Rights; or

Bonus also entitled for Rights; or

Rights also entitled for Bonus

Abbreviation Trading Status SUS Suspended OTW Opening SES Continuous Trading 1 Order entry authorized 2 Order entry forbidden

-

Commission rate and charges

-

Minimum bid size

RMB 0.01

-

Trading holidays

-

Additional information on trading

- You are not allowed to buy shares and subsequently sell them on the same trading day. Shares bought on T day can only be sold on T+1 onwards.

- Short selling is strictly prohibited.

- Buy orders must be in board lot of 100 units; odd lot trading is only available for sell orders.

- Only Limit Order is allowed.

- The maximum order size is 1 million units.

- The trading currency is in RMB. Investors are allowed to settle their trades in RMB if they have a RMB account. Customers can only settle their trades using other currencies as long as those currencies are not controlled currencies.

- Available for trading via iOCBC, Android TradeMobile (version 2.01 and above) and iPhone TradeMobile (version 2.03 and above).

-

Trading abbreviations

The following trading abbreviations will appear in the “Remarks” column on iOCBC trading platform. To find out more information on the corporate action or trading status on the listed companies, kindly refer to the official websites of the respective Exchanges.

Abbreviation Trading Status AUC Pre-open call auction session SDL Suspended TH Trading Halt BRK Break CLS Close

-

Commission rate and charges

-

Minimum bid size

Exchange Minimum bid size Shanghai B With minimum bid price of US$0.001 -

Trading holidays

-

Trading abbreviations

The following trading abbreviations will appear in the “Remarks” column on iOCBC trading platform. To find out more information on the corporate action or trading status on the listed companies, kindly refer to the official websites of the respective Exchanges.

Abbreviation Corporate Action Description SDL Suspended SUS Halt or Suspended TH Trading Halt BRK Break

-

Commission rate and charges

-

Minimum bid size

RMB 0.01

-

Trading holidays

-

Additional information on trading

-

Commission rate and charges

-

Minimum bid size

Exchange Minimum bid size Shenzhen B With minimum bid price of HK$0.001 -

Trading holidays

-

Trading abbreviations

The following trading abbreviations will appear in the “Remarks” column on iOCBC trading platform. To find out more information on the corporate action or trading status on the listed companies, kindly refer to the official websites of the respective Exchanges.

Abbreviation Corporate Action Description SDL Suspended SUS Halt or Suspended TH Trading Halt BRK Break

-

Commission rate and charges

-

Minimum bid size

Share price Minimum bid size Less than TWD10 0.01 TWD10 to less than TWD50 0.05 TWD50 to less than TWD100 0.10 TWD100 to less than TWD500 0.50 TWD500 to less than TWD1,000 1.00 TWD1,000+ 5.00 -

Trading holidays

-

Commission rate and charges

-

Minimum bid size

Stocks quoted on the Stock Exchange of Thailand are quoted in ‘number of shares’ instead of Board Lot

Share price (THB) Minimum bid size (THB) Less than 2 0.01 From 2 to < 5 0.02 From 5 to < 10 0.05 From 10 to < 25 0.10 From 25 to < 100 0.25 From 100 to < 200 0.50 From 200 to < 400 1.00 From 400 and up 2.00 -

Non-Voting Depository Receipt (NVDR)

An NVDR, or Non-Voting Depository Receipt, is a new trading instrument issued by Thai NVDR Co., Ltd. An NVDR is a valid security as specified by the Securities and Exchange Commission (Thailand) and is automatically regarded as a listed security by the Stock Exchange of Thailand. To find out more about NVDRs, kindly visit The Stock Exchange of Thailand website.

Note:

Thailand shares can come in 3 types – Local, Foreign and Non-voting Depository Receipt (NVDR).For any trade on Local shares submitted via iOCBC, it will be processed as NVDR shares with our Thai Broker. In the event the stock does not have NVDR shares, Local shares will be processed instead.

Foreigners i.e. non-Thailand citizens holding Local shares, are not entitled to voting rights and dividends. In order to be entitled to voting rights and dividends, please contact your designated Trading Representative 5 business days in advance of the relevant book-closing date to initiate conversion of your Local shares to Foreign shares to obtain all beneficial rights.

In the event that foreign ownership limit, which is monitored by Thailand Securities Depository (TSD), has been reached, your request to convert Local shares to Foreign shares will be placed on queue and automatically converted once foreign ownership room becomes available.

Scenario 1 – Sample Stock with Local, Foreign and NVDR listing in iOCBCStock Name Stock Code Remarks PTG Energy PTG Stock Code without suffix denotes Local Shares PTG Energy - F PTG-F Stock Code with suffix F denotes foreign shares PTG Energy - R PTG-R Stock Code with suffix R denotes NVDR Scenario 2 – Sample stock with only Local and Foreign Shares

Stock Name Stock Code Remarks BTS Rail MAS-U BTSGIF Stock Code without suffix denotes Local Shares BTS Rail MAS-U/F BTSGIF-F Stock Code with suffix -F denotes Foreign Shares -

Trading holidays

-

Trading abbreviations

The following trading abbreviations will appear in the “Remarks” column on iOCBC trading platform. To find out more information on the corporate action or trading status on the listed companies, kindly refer to the official websites of the respective Exchanges.

Abbreviation Corporate Action Description XA Ex-All (e.g. Ex-Dividend & Ex-Rights) XD Ex-Dividend XN Ex-Capital Return XR Ex-Rights XS Ex-Short-term Warrant XT Ex-TSR XW Ex-Warrant XB Ex-Other Benefit X Delisted stock

(set for stock which will be delisted on next trading day)

Abbreviation Trading Status PIN Notice Pending SPC Suspension / Non compliance COM Non compliance SUS Security Suspended TH Halt MHL Market Halt CBR Circuit Breaker -

Turnover list

The Stock Exchange of Thailand (SET) has issued a supervisory measure to curb speculation in stocks that has high turnover (known as stocks under “turnover list” that will be announced weekly by the SET).

If you wish to buy stock in the turnover list, please note that you are required to pay cash upfront to OCBC Securities Pte Ltd in full amount*. Once we have received your funds and made arrangement with our broker at Thailand, you may then proceed to place buy order for stock in the turnover list. Any order placed online without any cash upfront will be rejected by our company.

* You may use the previous closing price to estimate the funds that you require to place upfront with our Company. In the event that there is shortfall of funds, you will not be able to execute any trade. To avoid any delay in your order execution, you may wish to place more funds with us, any balances will be refunded to your account after the trade is executed and fully settled.