Market Information

Market Information

Market Information

-

Commission rate and charges

-

Indicative Equilibrium Price (IEP)

The indicative equilibrium price (“IEP”) is the price at which orders would be executed if auction matching were to occur at that point. SGX publishes the IEP on a real-time basis and masks all better bid and ask prices as well as quantities. The publication of the IEP is intended to provide more market transparency. The IEP acts as an indication of the eventual opening or closing price, which helps market participants assess the market and adjust their orders accordingly. The masking of all better bid/ask prices and quantities is included as a safeguard against manipulation of the eventual equilibrium price.

Refer to SGX website for more details.

Source: SGX -

Trading in SGX Unit Share Market

The Unit Share Market, also known as the Odd Lot Market, allows clients to trade in quantities less than the standard Board Lot. The minimum trade quantity is 1 share.

To trade on the SGX Unit Share Market, you will need to go to the “Market Information” page, and select “SGX Unit Market”.For example, if you wish to trade 180 units of Company ABC shares, you will have to enter the orders as follows:

Step 1: Enter 100 units in the Board Lot market with designated board lot of 100 units

Step 2: Enter 80 units in the SGX Unit Share Market

(The orders will be subject to the trading conditions in the respective markets)Note :

In Unit Share market, the minimum fulfillment can be only 1 share and the usual online commission of S$25 or 0.275% of trade value (whichever is higher), shall apply. As such, you must bear in mind this possible situation when queuing in the Unit Share market. To avoid such situation, you may wish to buy or sell directly based on the best available price.To check for the board lot size

You may view the board lot size of each stock in the iOCBC order ticket as below. You may enter any quantity that is lesser than the designated board lot size. For example, with a board lot size 10 units, you can enter 9 or less units under SGX Unit Share Market.

-

Minimum Bid Size

Minimum Bid Size for the S$1.00 to S$1.99 price range has now widened from the previous S$0.005 to S$0.01 for all securities traded in SGX since 13 November 2017 (excluding preference shares, structured warrants, exchange traded funds, exchange traded notes, debentures, bonds and loan stocks).

In addition, the Forced Order Range has also been widened from previous +/- 20 bids to +/- 30 bids for all securities traded in SGX since 13 November 2017 (excluding preference shares, structured warrants, exchange traded funds, exchange traded notes, debentures, bonds and loan stocks).

For example, if ABC shares were last traded at S$3.260, the price allowed to enter will be calculated to be +/- 30 bids from S$3.260. In this case, the bids range will be S$2.961 and S$3.561.

For preference shares in the S$100 price convention, a Forced Order Range of +/- 1,000 ticks will apply.

Minimum Bid Size and Forced Order Range for securities traded on the SGX in SGD

Product Price Range (SGD) Minimum Bid size (SGD) Forced Order Range Stocks (excluding preference shares), Real Estate Investment Trusts (REITS), business trusts, company warrants and any other class of securities or Futures Contracts not specified in the rows below Below 0.20 0.001 +/- 30 bids from last done price 0.20 - 0.995 0.005 1.00 and above 0.01 Structured warrants Below 0.20 0.001 +/- 30 bids from last done price 0.20 - 1.995 0.005 2.00 and above 0.01

Daily Leverage Certificates (DLCs)Below 0.006 0.001 +/-300% from last done price 0.006 - 0.199 0.001 +/-50% from last done price 0.200 - 1.995 0.005 2.000 - 999.990 0.010 Exchange traded funds and exchange traded notes All 0.01 or 0.001 as SGX-ST determines +/- 30 bids from last done price Debentures, bonds, loan stocks and preference shares quoted in the $1 price convention All 0.001 Debentures, bonds, loan stocks and preference shares quoted in the $100 price convention All 0.001 +/- 1,000 bids from last done price Minimum Bid Size for securities traded on the SGX in HKD

Product Price Range (HKD) Minimum Bid Size (HKD) Forced Order Range Securities denominated in Hong Kong Dollar Below 0.25 0.001 +/- 30 bids from last done price 0.25 - 0.495 0.005 0.50 - 9.99 0.01 10.00 - 19.98 0.02 20.00 - 99.95 0.05 100 - 199.90 0.1 200 - 499.80 0.2 500 and above 0.5 Minimum Bid Size for securities traded on the SGX in JPY

Product Price Range (JPY) Minimum Bid Size (JPY) Forced Order Range Securities denominated in Japanese Yen Below 2,000 1 +/- 30 bids from last done price 2,000 - 2,995 5 3,000 - 29,990 10 30,000 - 49,950 50 50,000 - 99,900 100 100,000 and above 1,000 Notes:

- Buy bids are limited up to the specified bids below the last done price

- Sell bids are limited up to specified bids above the last done price

- Price entered that is more than the specified bids from the last done price will be rejected unless you select the ‘force order’ option

- Force key is granted to client at the sole discretion by the Company and trading representative

- You will bear the risk of keying in undesirable price by mistake

- More details on Minimum Bid Size and Forced Order Range.

-

Trading holidays

-

Trading abbreviations

The following trading abbreviations will appear in the “Remarks” column on iOCBC trading platform. To find out more information on the corporate action or trading status on the listed companies, kindly refer to the official websites of the respective Exchanges.

Abbreviation Corporate Action Description C1 Cum Dividend 2 C2 Cum Rights 2 C3 Cum Bonus 2 C4 Cum Offer 2 C5 Cum Interest 2 C6 Cum Entitlement 2 CA Cum All CB Cum Bonus CD Cum Dividend CE Cum Entitlement CI Cum Interest CO/CTO Cum Offer CR Cum Rights CT Conditional Trading CW Conditional When Issued WI When Issued XA Ex All XB Ex Bonus XD Ex Dividend XE Ex Entitlement XI Ex Interest XO/XTO Ex Offer XR Ex Rights Abbreviation Trading Status SUS Security suspended from trading SDL Delisted trades TH Trading Halt HRS Halt due to Circuit Breaker Triggered CBR Circuit Breaker PL Pending listing BI Buying in only J Adjustment MCE Mandatory Call Event PO1 Pre-Open1 PO2 Pre-Open2 N-C Non-Cancel -

Price quotation and trading information

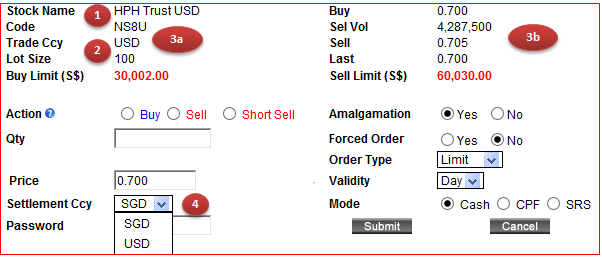

Securities quoted and traded on SGX are, by default, in Singapore dollars. For securities that are quoted and traded in other currencies, the currency type will appear at the end of the security name. For examples:

Security Name

Traded Currency

Board Lot

Size

Allowed Settlement Currency

HPH Trust SGD

(Code: P7VU)

SGD

100

SGD

HPH Trust USD

(Code: NS8U)

USD

100

USD or SGD

HongkongLand USD

(Code: H78)

USD

100

USD or SGD

Shangri-La HKD

(Code: S07)

HKD

100

HKD or SGD

Creative

(Code: C76)

SGD

50

SGD

Singtel

(Code: Z74)

SGD

100

SGD

Singtel 10

(Code: Z77)

SGD

10

SGD

The list provided is for illustration purpose and may not be exhaustive. You are advised to refer to SGX website for more information.

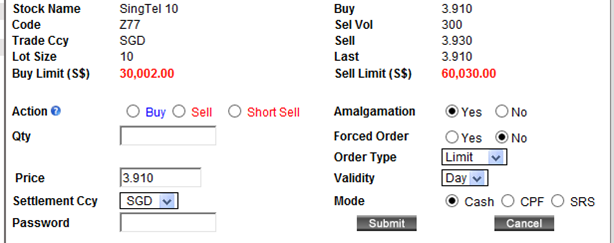

You may also view the security information under the Buy/Sell ticket. Kindly refer to the step-by-step guide below:

Step 1: Select your desired stock

Step 2 : Check on the Board Lot Size and enter number of units in multiple of board lot size (e.g. 100, 300, 500, 1400, 2200)|

Step 3: Check on the “Traded Currency” and “Price” information (i.e. make cross reference to the Last Done Price/Buy or Sell Price as different securities are traded differently in terms of currencies and bid size)

Step 4: You can opt to settle your trades in the same traded currency or SGD

Step 5: Ensure that you have entered the correct information on the buy/sell ticket before you submit your order to the Exchange

Explore both developed and emerging markets in the region.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade in some of the world's most established markets.

|

|

Trade in some of the world's most established markets.

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|