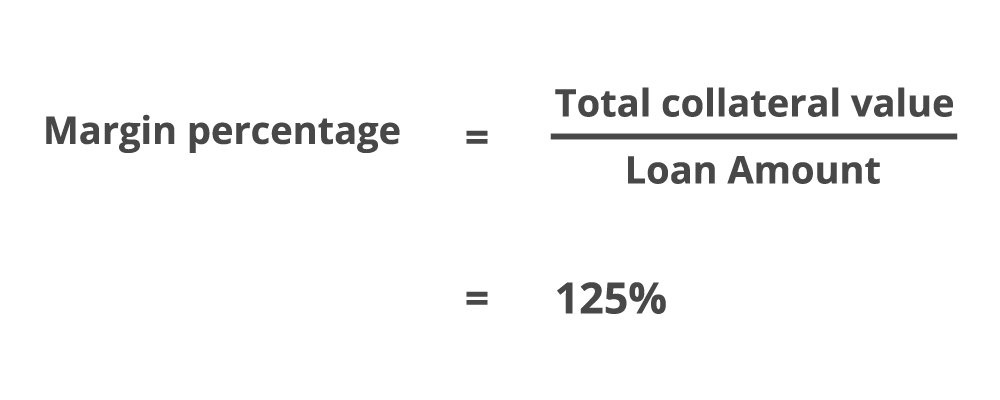

Collateral amount

S$10,000

Purchasing amount

S$40,000 (4 times)

Margin percentage

125%

Total share value/ loan amount

(S$10,000 + S$40,000) / S$40,000

This powerful trading support tool provides a comprehensive analysis report on every stock across five markets so you can invest smarter on the go.

Access 40 low-carbon companies in Singapore across sectors like real estate, financials and technology.

Introducing A.I. Oscar, your virtual trading assistant who analyses market signals to offer you stock ideas.

Share financing lets you trade up to 5 times your original value with cash pledged as collateral and up to 4 times with shares pledged as collateral.

Anyone age 21 and above, with a Basic Trading Account

Enjoy interest rates as low as 4.00% p.a. with QPL+ (T&Cs apply)Find out more

Apply at a branch with these supporting documents

For Singaporeans and Permanent Residents:

For Malaysians:

For Foreigners:

Note: Bring the originals of these Identification Documents (ID)

Provide us with the original or electronic copy of any of the following documents reflecting your name and address:

Note: Document(s) must be dated no older than 3 months from date of application. If your mailing address is different from your residential address, please provide one document for each address.

If you are applying for a corporate account, please call us at 1800 338 8688

Mail in the completed application forms with copies of:

Required for all:

Optional Forms

Provide a copy of your identification:

For Singaporeans and Permanent Residents:

For Malaysians:

For Foreigners:

Bring your original ID, the photocopy and our account application form to any of the below authorised parties to witness your signature on the form and certify true copy of your ID:

The witnessing officer should provide his/her name and contact details.

Provide us with the original or electronic copy of any of the following documents reflecting your name and address:

Note: Document(s) must be dated no older than 3 months from date of application. If your mailing address is different from your residential address, please provide one document for each address.

Mail it to us

OCBC Securities Private Limited

18 Church Street #01-00,

OCBC Centre South,

Singapore 049479

Our Quality-Priced Loan scheme lowers your interest rates when you increase the proportion of high-quality shares in your Share Financing portfolio under our Quality-Priced Loan scheme.

Our Quality-Priced Loan scheme lowers your interest rates when you increase the proportion of high-quality shares in your Share Financing portfolio under our Quality-Priced Loan scheme.

The Share Financing Simulator on our iOCBC trading platform helps calculate your margin percentage

The Share Financing Simulator on our iOCBC trading platform helps calculate your margin percentage

We can finance your trades in 4 different currencies: SGD, HKD, USD and AUD. This lets you take up a loan, execute and settle your trades in multiple currencies and reduce unnecessary foreign exchange conversion costs.

View more details on our Multi-Currency Share Financing feature.

We can finance your trades in 4 different currencies: SGD, HKD, USD and AUD. This lets you take up a loan, execute and settle your trades in multiple currencies and reduce unnecessary foreign exchange conversion costs.

View more details on our Multi-Currency Share Financing feature.

We accept over 3,000 listed securities across 5 major markets: Singapore, Hong Kong, US, Australia and Malaysia. The marginable securities span across many different asset classes, such as Company Shares, Real Estate Investment Trusts (REITS), Bonds, Exchange-Traded funds (ETFs) and American Depository Receipts (ADRs).

We accept over 3,000 listed securities across 5 major markets: Singapore, Hong Kong, US, Australia and Malaysia. The marginable securities span across many different asset classes, such as Company Shares, Real Estate Investment Trusts (REITS), Bonds, Exchange-Traded funds (ETFs) and American Depository Receipts (ADRs).

| Quality of Marginable Securities | Description | SGD Lending Rates | USD Lending Rates | HKD Lending Rates | AUD Lending Rates | |

| Grade 1 | Major Global Index Component Securities | 4.50% | 5.70% | 5.00% | 5.25% | |

| Grade 2 | Top 100 securities by market capitalisation in respective exchanges that have met certain financial and trading criteria as determined by OCBC Securities | 4.80% | 5.90% | 5.50% | 5.50% | |

| Grade 3 | Mid/Small Cap Securities | 5.20% | 6.00% | 5.75% | 5.75% | |

| Grade 4 | All other Marginable Securities | 7.00% | 7.00% | 7.00% | 7.50% | |

Existing Share Financing account holders

Simply complete the QPL+ Selection Form and mail it to us.

If you do not have a Share Financing account, open one with us

Download this Application Form, Memorandum of Charge form, as well as QPL+ Selection Form and mail them to us to open one.

OCBC Securities Investors Hub

18 Church Street

#01-00 OCBC Centre South

Singapore 049479What is the Quality Priced Loan scheme about?

With our first-to-market Quality Priced Loan scheme, you stand to enjoy lower interest rates based on the quality of securities in your portfolio starting from 4.50% p.a. with the new QPL+. To view our list of marginable securities and their grading, click here.

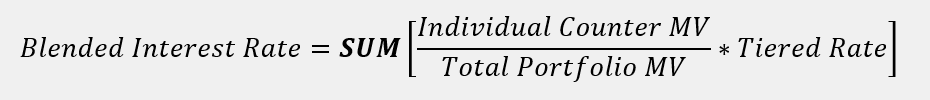

How are the interest rates calculated?

A blended Interest rate shall be calculated based on the relevant interest rates corresponding to the various grades and will depend on the concentration of Marginable Securities customer holds from each tier.

Marginable value of the customer’s portfolio as at previous business day, including all outstanding trades will be used for the computation of the interest rates daily.

The following examples illustrate how interest rates are computed based on the quality and marginable securities in the customer’s portfolio. The blended interest rate in each example is derived from the below formula.

| Counter | Grade | MV of security | Tiered Rate |

| Company ABC (SGD) | 1 | S$100,000 | 4.50% |

| Company DEF (AUD) | 2 | S$20,000 | 5.50% |

| Company GHI (HKD) | 3 | S$10,000 | 5.75% |

| Total | - | S$130,000 | - |

| Counter | Grade | MV of security | Tiered Rate |

| Company ABC (SGD) | 1 | S$100,000 | 4.50% |

| Total | - | S$100,000 | - |

| Counter | Grade | MV of security | Tiered Rate |

| Company ABC (AUD) | 1 | S$50,000 | 5.25% |

| Company DEF (SGD) | 3 | S$50,000 | 5.20% |

| Company GHI (USD) | 4 | S$20,000 | 7.00% |

| Total | - | S$120,000 | - |

What happens when the promotion ends?

The normal QPL scheme will kick in when the QPL+ promotion ends. To view the normal rates, click here.

Important Notes

For full terms and conditions of Quality Priced Loan Plus promotion (“Promotion”), click here.

Borrowing to finance the trading of securities (leveraging/gearing) carries a high degree of risk. If the value of the collateral declines substantially, falling below the maintenance margin requirement, you may be called upon to deposit substantial additional funds or collaterals on short notice in order to maintain your position. If you fail to comply with a request for additional funds or collaterals within the specified time, your position may be liquidated at a loss and you will be liable for any resulting deficit in your account. Trading in foreign securities includes, but is not limited to, currency risks and rules and regulations peculiar to the respective foreign stock markets.

Customers should note that there are limitations and difficulties in using examples, tables or illustrations to provide a full explanation or depiction. All information, statements, figures, content, explanations, examples, and details (collectively, the “Information”) contained above is intended for illustrative and/or information purposes only and should not be relied upon for any purpose whatsoever. Customers should, in the event of any doubt as to how to read or understand the examples, tables, illustration or information, contact OCBC Securities Private Limited for a fuller explanation, depiction or further details.

Share as Collateral |

Cash as Collateral |

|

| Leveraging trading up to | 4 times | 5 times |

| Collateral amount | S$10,000 |

S$10,000 |

| Purchasing amount |

S$40,000 (4 times) |

S$50,000 (5 times) |

| Margin percentage |

125% |

125% |

Leveraging trading up to

4 times

Collateral amount

S$10,000

Purchasing amount

S$40,000 (4 times)

Margin percentage

125%

Total share value/ loan amount

(S$10,000 + S$40,000) / S$40,000

Leveraging trading up to

5 times

Collateral amount

S$10,000

Purchasing amount

S$50,000 (5 times)

Margin percentage

125%

Total share value/ loan amount

S$50,000 / (S$50,000 - S$10,000)

Minimum age

Age 21 and above

Minimum cash deposit of $5,000 (in SGD or SGD equivalent) or deposit $5,000 (in SGD or SGD equivalent) worth of marginable securities

Your Share Financing account will be linked to a designated sub-account maintained by us with Central Depository (CDP). When you deposit or purchase securities listed on SGX, they will be custodised in this sub-account. For securities listed in other foreign stock exchanges, they will be custodised with an established global custody service provider.

Margin call is an industry wide practice for any form of leveraged trading. Your margin percentage is calculated as follows:

If the value of your collateral falls or if the FX rate moves against SGD, your margin percentage will fall. When the margin falls below 125%, a margin call will take place and you will need to restore it 125% by either liquidating shares or providing additional collateral.

| If Margin Ratio falls | What happens |

| Between 115%-125% | Margin call to restore the margin percentage to 125% within 2 market days |

| Below 115% | Margin call to restore the margin percentage within the date of notice |

|

Example:

|

|

|

However during the loan period, the value of his collateral falls by S$2,000, causing his margin percentage to drop to 120% |

|

| Here are actions he can take to restore his margin percentage to 125% Option 1: Top up S$1,600 in cash |

|

| Option 2: Deposit additional S$2,000 worth of shares |

|

| Option 3: Liquidate S$8,000 worth of shares (at possible loss) |

|

Trade over 40 FX pairs with up to 40 times leverage.

You are now leaving the OCBC Securities website and about to enter a third-party website over which OCBC Securities has no control over and is not responsible for. Before you proceed to use the third party website, please review the terms of use and privacy policy of their website. OCBC Securities’ Conditions of Access and Privacy and Security Policies do not apply at third party websites.