An Accredited Investor refers to:

(i) an individual --

(A) whose net personal assets exceed in value $2 million (or its equivalent in a foreign currency) or;

(B) whose financial assets (net of any related liabilities) exceed in value $1 million (or its equivalent in a foreign currency), where "financial asset" means --

(BA) a deposit as defined in section 4B of the Banking Act;

(BB) an investment product as defined in section 2(1) of the Financial Advisers Act; or

(BC) any other asset as may be prescribed by regulations made under section 341; or

(C) whose income in the preceding 12 months is not less than $300,000 (or its equivalent in a foreign currency);

(ii) a corporation with net assets exceeding $10 million iin value (or its equivalent in a foreign currency) as determined by --

(A) the most recent audited balance-sheet of the corporation; or

(B) where the corporation is not required to prepare audited accounts regularly, a balance-sheet of the corporation certified by the corporation as giving a true and fair view of the state of affairs of the corporation as of the date of the balance-sheet, which date shall be within the preceding 12 months;

(iii) the trustee of such trust when acting in that capacity

Equity-Linked Notes (ELNs)

Earn interest while waiting for your ideal entry price

For local application

Apply at a branch with these supporting documents

-

For Singaporeans and Permanent Residents:

- NRIC/SAF/SPF ID and Passport

For Malaysians:

- IC and Singapore Residence Pass (e.g. Employment pass) if applicable

For Foreigners:

- Valid Passport and Singapore Residence Pass (e.g. Employment pass) if applicable

-

Provide us with the original or electronic copy of any of the following documents relflecting your name and address:

- Phone bill

- Bank statement

- Income tax statement

- CPF statement

- CDP statement

Note: Document(s) must be dated no older than 3 months from date of application. If your mailing address is different from your residential address, please provide one document for each address.

For overseas application

Mail in the completed application forms with copies of:

-

Required for all:

-

Provide a copy of your identification:

Bring your ID and and our application form to any of the authorised parties below to:

1. Witness your signature on the form

2. Certify true copy of your ID

Authorised Parties- Notary Public

- Advocates & Solicitors

- Singapore Embassy

For Singaporeans and Permanent Residents:- NRIC/SAF/SPF ID and Passport

For Malaysians:

- IC and Singapore Residence Pass (e.g. Employment pass) if applicable

For Foreigners:

- Valid Passport and SIngapore Residence Pass (e.g. Employment pass) if applicable

-

Provide us with the original or electronic copy of any of the following documents relflecting your name and address:

- Phone bill

- Bank statement

- Income tax statement

- CPF statement

- CDP statement

Note: Document(s) must be dated no older than 3 months from date of application. If your mailing address is different from your residential address, please provide one document for each address.

-

Mail it to us

OCBC Securities Private Limited

18 Church Street #01-00,

OCBC Centre South,

Singapore 049479

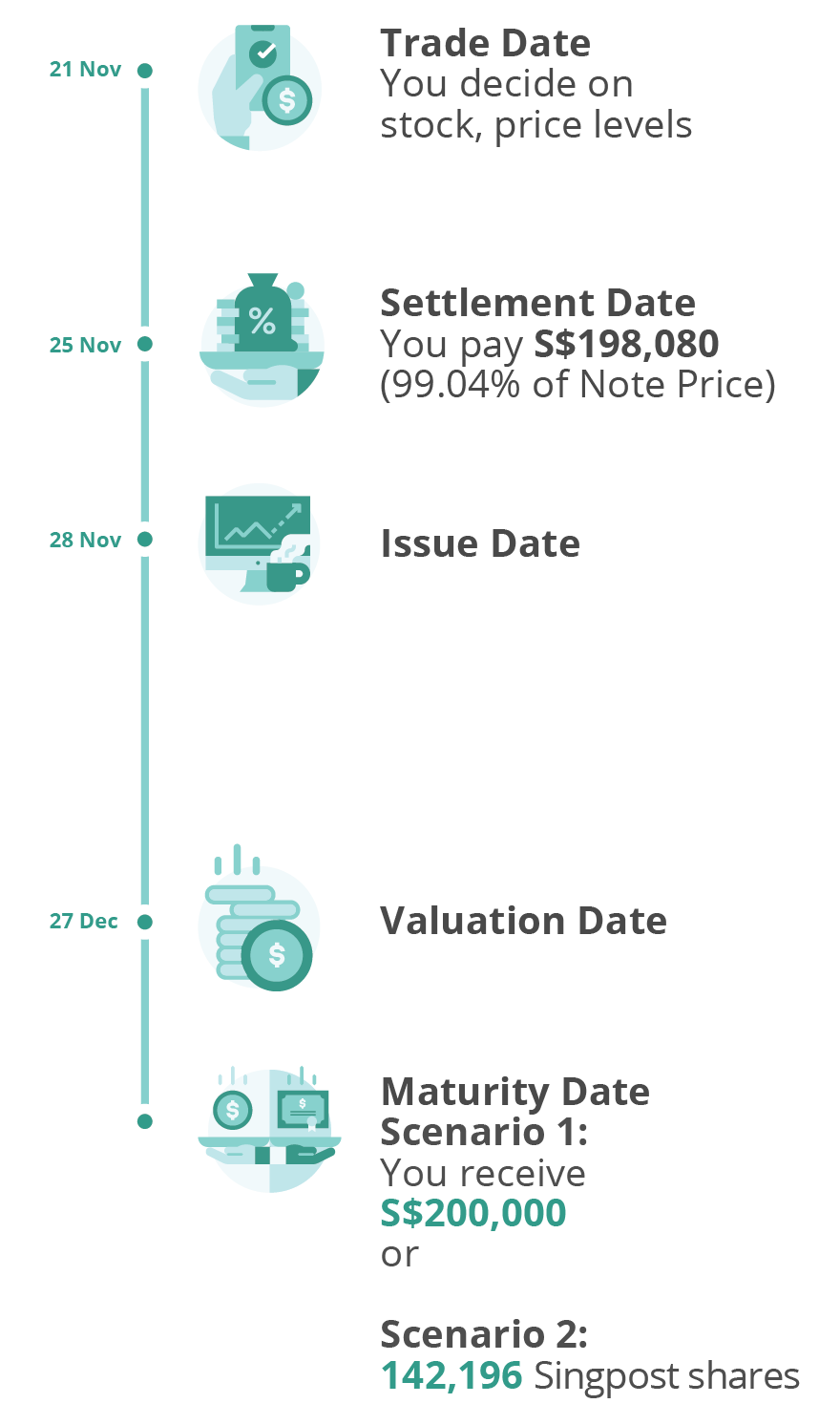

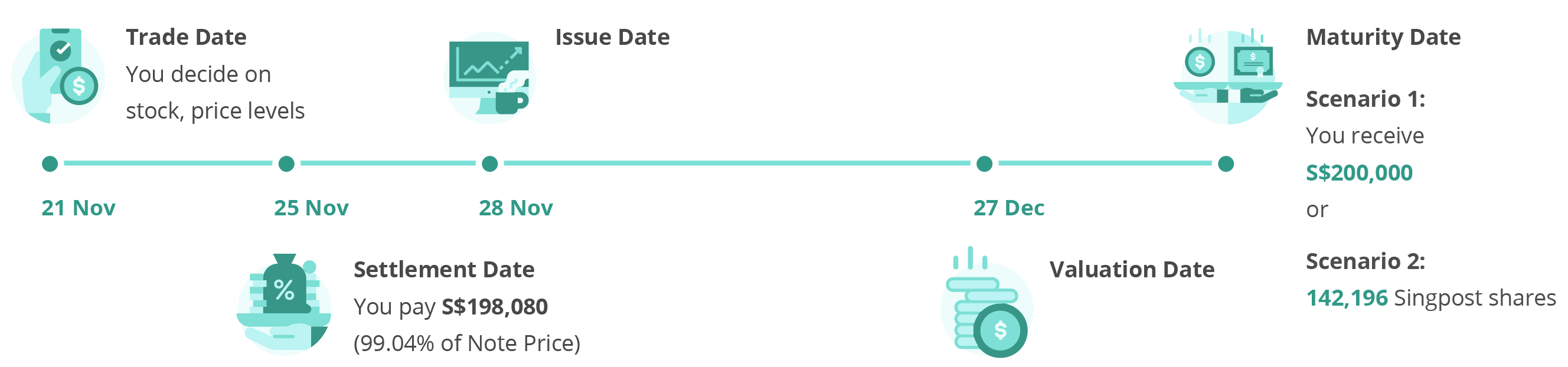

Customise your very own Equity-Linked Note

Pay a discount to Principal Amount and get back 100% of Principal Amount on Maturity. The difference is your profit, and this will be reflected in the quoted annualised yield. Pick the stock you like, at the price you don't mind collecting (the strike price). Customise your own stock, tenor & strike price.

Spot Price

S$1.45

Strike Price (97% of Spot Price)

S$1.4065

Principal Amount

S$200,000

Client pays

S$198,080

Yield pa

11.16%

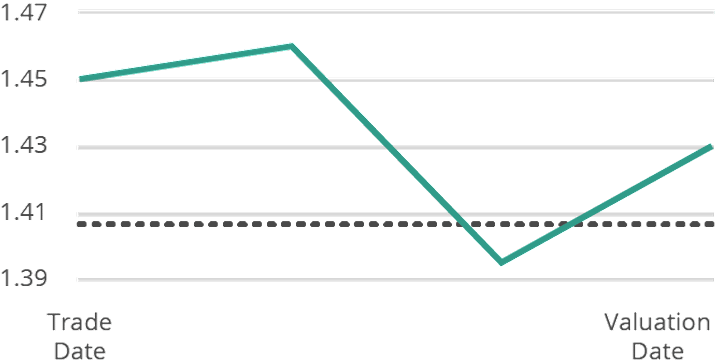

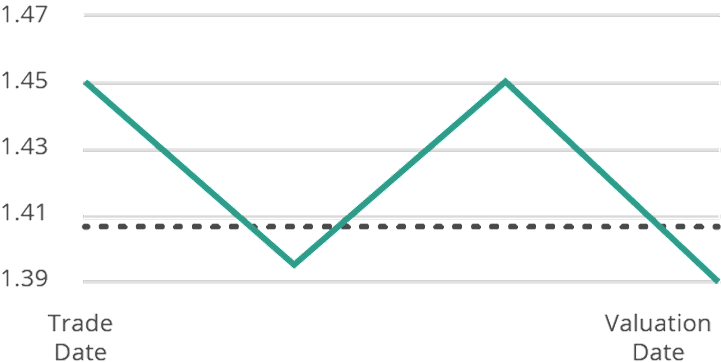

Scenario 1

Singpost closes at or above strike on Valuation Date.

Outcome: Client gets cash

Scenario 2

Singpost closes below strike on Valuation Date.

Outcome: Client gets shares

Stock Price

Strike Price

Start trading ELNs

ELNs are only available for Accredited Investors.

Eligibility requirements

Accredited Investors only.

Common question

Bonds

A form of fixed-income securities issued by governments or companies to raise funds from the financial markets.

Basic Trading Account

A cash trading account for trading in Singapore and foreign markets.

Share Financing

A leveraged trading account that lets you increase your share purchasing power by pledging your cash or securities as collateral.