Exchange traded Funds (ETFs) provide you access to a diversified portfolio of securities, and allow you to track the performance of asset classes like shares, bonds or commodities. With ETFs, you can instantly invest in a basket of securities without having to purchase the individual shares.

Lion-OCBC Securities Singapore Low Carbon ETF

Singapore’s Top Green Leaders. All in One ETF.

Exclusive offer: S$0 commission for buy trades

Find out more

Unlock the potential of Singapore’s first low-carbon ETF—a diversified fund that taps into the lower carbon footprint of 40 Singapore companies.

Lion-OCBC Securities Singapore Low Carbon ETF tracks the iEdge-OCBC Singapore Low Carbon Select 40 Capped Index, which aims to track the top 40 companies by Free-Float Market Capitalisation domiciled or incorporated in Singapore, with a focus on portfolio decarbonisation through the reduction of Weighted Average Carbon Intensity of a portfolio.

*Top Dividend Paying Singapore equities ETFs in 2024

*2nd best Performing Singapore equities ETFs in 2024

*Top performing sustainability linked ETF on SGX, 2024

Source: ETF market highlights 4Q 2024, SGX

*Past performance is not necessarily indicative of future performance.

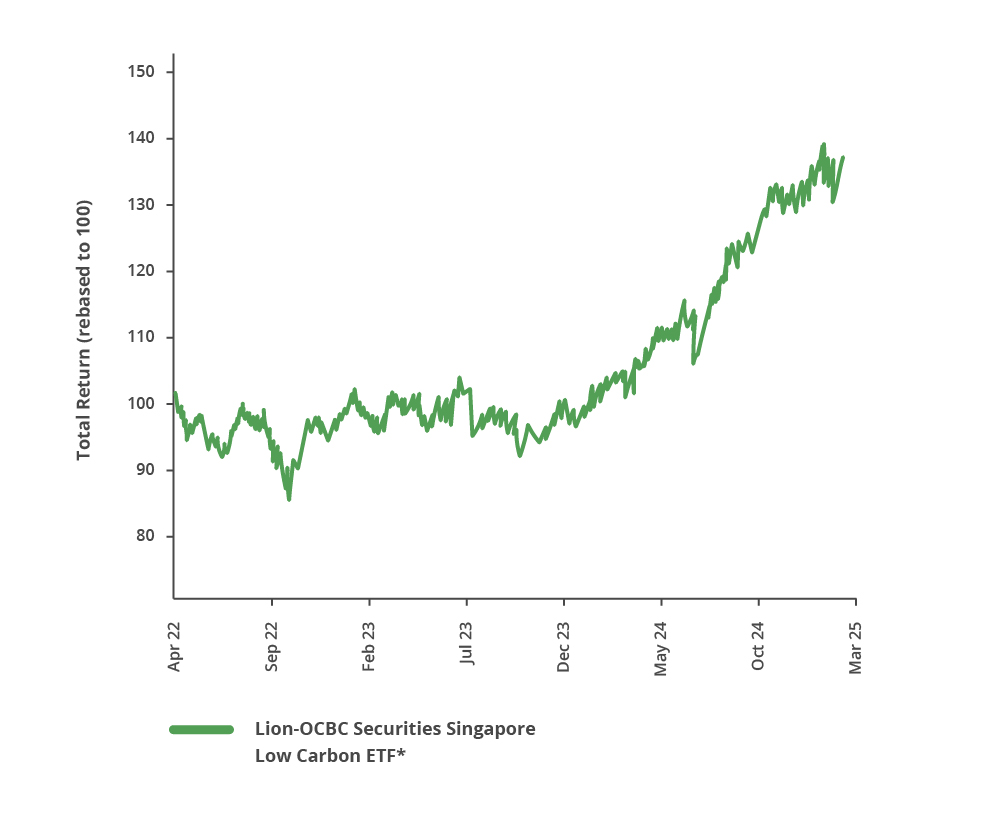

*Returns are based on NAV-NAV basis in SGD and assuming all dividends are reinvested net of all charges payable upon reinvestment. Performance is calculated in the base currency of the Fund. The Lion-OCBC Securities Singapore Low Carbon ETF was listed on 28 April 2022. Past performance, as well as any prediction, projection, or forecast are not necessarily indicative of future or likely performance. Opinions and estimates constitute our judgment and along with other portfolio data, are subject to change without notice.

Source: Bloomberg as of 31 March 2025

Past performance is not necessarily indicative of future performance.

Climate change is the defining crisis of our time. As the biggest long-term threat to humanity, the need to transit to a low-carbon economy is more urgent than ever. Investors now recognise the importance of managing the risks and seizing the opportunities that climate change presents. Increasingly, more capital is allocated to align investment portfolios with a low-carbon and climate-resilient future. The Lion-OCBC Securities Singapore Low Carbon ETF gives you the opportunity to embark on the decarbonisation journey of Singapore’s real and financial economy.

|

|

Effective 21 March 2025, this ETF will no longer have fossil fuel involvement. We have reduced the threshold for fossil fuel revenue involvement to 0%, ensuring that only companies with minimal or no fossil fuel exposure are included in the ETF's portfolio.

Note: Securities referenced are not intended as recommendations to buy or sell any capital markets products. Opinions and estimates constitute our judgment and along with other portfolio data, are subject to change without notice.

Source: SGX Index Edge, as of 31 March 2025

The Lion-OCBC Securities Singapore Low Carbon ETF will track the iEdge OCBC Singapore Low Carbon Select 40 Capped Index after 21 March 2025.

iEdge-OCBC Singapore Low Carbon select 40 Capped Index

Financials

30.6%

Real Estate

23.2%

Technology

11.6%

Telecommunications

8.9%

Industrials

7.8%

Consumer Discretionary

13.4%

Utilities

3.7%

Consumer Staples

0.4%

Health Care

0.5%

Source: SGX Index Edge, as of 31 March 2025

The chart will be revised when the iEdge-OCBC Singapore Low Carbon Select 40 Capped Index is rebalanced.

|

|

More details on the LION-OCBC SECURITIES SINGAPORE LOW CARBON ETF

CDP Charges

Clearing fee

: 0.0325% + GST

Trading fee

: 0.0075% + GST

Settlement instructions

: S$0.35 + GST

Commission rates for SGX Market (traded currency in SGD)

Contract value

Broker assisted

Online

Up to S$50,000

0.50%

0.275%

S$50,000 - S$100,000

0.40%

0.22%

More than S$100,000

0.25%

0.18%

Minimum commission

S$40

S$25

Understanding the risks

The ETF is subject to the following principal risks including but not limited to market risk, index sector risks, concentration risk, tracking error risk, foreign exchange risk and risk factors relating to the index. Some or all of the risks may adversely affect the Fund’s Net Asset Value, yield, total return and/or its ability to achieve its investment objective. You should note the risk factors associated with investing in the ETF fund for sustainable energy and more. The statements in the prospectus are intended to be summaries of some of these risks. They are by no means exhaustive and they do not offer advice on the suitability of investing in the ETF. You should read the prospectus and carefully consider the risk factors described together with all of the other information included in the prospectus before deciding whether to invest in your chosen environmentally friendly fund.

Read the disclaimer

The information provided herein is a compilation or summary of materials and data based from external sources available to OCBC Securities Private Limited (“OSPL”), and does not represent OSPL’s view on the matters mentioned. Whilst we have taken all reasonable care to ensure that the information contained in this advertisement or publication is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness, and you should not act on it without first independently verifying its contents. Where any graph, chart, formula or device is included, there may be limitations and difficulties in respect of its use. Trading in capital market products and borrowing to finance the trading transactions (including, but not limited to leveraged trading or gearing) can be very risky, and you may lose all or more than the amount invested or deposited. Where necessary, please seek advice from an independent financial adviser regarding the suitability of any trade or investment product taking into account your investment objectives, financial situation or particular needs before making a commitment to trade or purchase the investment product. If you choose not to seek independent financial advice, please consider whether the trade or product in question is suitable for you. You should consider carefully and exercise caution in making any trading decision whether or not you have received advice from any financial adviser. You should also read the relevant prospectus and/or profile statement (a copy of which may be obtained from the relevant fund manager or any of its approved distributors), prior to any trading or investment decision. In relation to collective investment schemes, the value of the units and the income accruing therefrom, if any, may rise or fall. Past performance, yields and payments, as well as, any prediction, projection, or forecast are not necessarily indicative of the future or likely performance, yields and payments of the ETF. For funds that are listed on an approved exchange, investors are not allowed to redeem their units in those funds with the manager, except under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units. No representation or warranty whatsoever (including without limitation any representation or warranty as to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (including without limitation any statement, figures, opinion, view or estimate) provided herein is given by OSPL and it should not be relied upon as such. OSPL does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. OSPL shall not be responsible for any loss or damage howsoever arising, directly or indirectly, as a result of any person acting on any information provided herein.

The information provided herein is intended for general circulation/discussion purposes only and may not be published or circulated in whole or in part without our written consent. All trademarks, registered trademarks, product names and company names or logos mentioned herein are the property of their respective owners, and you agree that you will not do anything to infringe or prejudice those rights. Reference to any products, services, processes or other information, does not constitute or imply endorsement, sponsorship or recommendation thereof by OSPL. Past performance is not necessarily indicative of future performance.

^As set out in the prospectus, distribution payments shall, at the sole discretion of the fund manager, be made out of either (a) income, (b) net capital gains, (c) capital of the fund, or a combination of (a) and/or (b) and/or (c). Distributions are not guaranteed and may fluctuate. Past distributions are not necessarily indicative of future distributions. Distribution payouts and their frequency may be changed at the fund manager’s discretion. Any payment of distributions by the fund may result in an immediate reduction of the net asset value per share/unit. Please refer to the fund prospectus and the LGI website for more information on the fund’s distribution policy.

FAQs about the Lion-OCBC Securities Singapore Low Carbon ETF

ESG stands for Environmental, Social, and Governance. ESG investing is the consideration of environmental, social and governance (ESG) factors alongside financial factors, in the investment decision-making process.

Different labels like sustainable investing, socially responsible investing, ethical investing and impact investing all form part of ESG investing, with ESG factors covering an extremely broad range of issues - from avoiding investing in tobacco companies to financing clean water initiatives.

Source: OCBC, Fidelity International.

There are two broad schools of thought when it comes to why ESG matters; one starts from the role of investors in society and the other focuses on risk management.

Many investor groups including pension funds, charities and endowment funds, see their role as more than just return-seekers. They are conscious that funding our retirements, financing societal initiatives and contributing to the cost of education, can give them a function within wider society.

With this responsibility comes influence. These investor groups manage significant pools of capital; directing this capital gives them a substantial amount of authority. They decide how and where they want their funds allocated, and can choose to favour investments that aim not to have a negative effect on society, or those targeting a positive effect.

The other major philosophy behind ESG is rooted in risk management.

Investors who take this approach incorporate ESG factors into their investment process to help mitigate risk. For example, a potential investment in a company with low ESG standards could expose the portfolio to a variety of risks faced by the company in the future, such as worker strikes, litigation and negative publicity, resulting in lower future returns. For investors, monitoring the ESG credentials of an investment can lead to better risk-based judgements.

Source: OCBC, Fidelity International.

The investment objective of the Fund is to replicate as closely as possible, before expenses, the performance of the iEdge-OCBC Singapore Low Carbon Select 40 Capped Index using a direct investment policy of investing in all, or substantially all, of the underlying Index Securities.

Source: Lion Global Investors. Read more.

The iEdge-OCBC Singapore Low Carbon Select 40 Capped Index aims to track the top 40 companies (including REITs and BTs) by Free- Float Market Capitalization that are representative of Singapore’s real and financial economy, with a focus on index decarbonisation through the selection of companies with no involvement in fossil fuels, and through the implementation of a Carbon Performance Exclusion Criteria that ensures best-in-class selections based on Scope 1 and 2 GHG emissions per unit revenue.

Source: SGX. Read more.

Lion-OCBC Securities Hang Seng TECH ETF

Capture the growth potential of the 30 largest TECH-themed companies on the Hong Kong Stock Exchange.

Lion-OCBC Securities China Leaders ETF

Capture the performance of the 80 largest Stock Connect-eligible Chinese companies.

Lion-OCBC Securities APAC Financials Dividend Plus ETF

The top 40 Singapore companies with lower carbon footprints

The top 40 Singapore companies with lower carbon footprints

This is based on the underlying Index Securities of the iEdge-OCBC Singapore Low Carbon Select 40 Capped Index.

Other participating dealers

Other participating dealers

- CGS-CIMB Securities (Singapore) Pte Ltd

- Flow Traders Asia Pte Ltd

- Futu Singapore Pte Ltd

- iFAST Financial Pte Ltd

- Phillip Securities Pte Ltd

- Tiger Brokers (Singapore) Pte Ltd

- UOB Kay Hian Pte Ltd

ETF Application Period

11 April 2022 (9am) to 21 April 2022 (12pm)

For OCBC Bank customers

For OCBC Securities customers

Call your Trading Representative (TR)

- Log in to your iOCBC online trading account via a browser on your computer.

- Click on “More” at the top menu.

- Select “Account Details” to view your TR’s contact details.

Questions? Email us at cs@ocbcsec.com or call 1800 338 8688.

For participating dealers’ customers

Approach your respective brokers for more details on how to apply. You should have an account with our participating dealers and will be subject to their terms and conditions.

Our participating dealers are CGS-CIMB, Flow Traders Asia, Futu Singapore, iFast Financial, Philip Securities, Tiger Brokers and UOB Kay Hian.